45 - Track and develop what is net worth

What is net worth?

Reason for this Goal: Understanding what is net worth —your assets (what you own) versus your liabilities (what you owe) and the tracking of your net worth, is important to growing your money and developing your wealth. Over time, you will see the benefits of how owning productive assets like real estate and stocks, will grow and increase your net worth.

Your net worth is a good measure of how wealthy you are, and is easy to track, because money is easy to count (versus your level of happiness which isn't so easy to track).

The tracking of your net worth will inspire you to make smart money and investment decisions that will improve your net worth throughout your life, especially when you start seeing it grow.

Understanding what is net worth and having a good net worth gives you the peace of mind and freedom to achieve your 100 life goals, knowing that you have the financial assets behind you to achieve goals such as your travel and lifestyle goals.

By inputting these financial numbers (assets and liabilities) into an Excel spreadsheet, or one of the other on-line tools that are available from your bank or as a downloadable app, you will gain confidence in your future.

What do I track in understanding what is Net Worth?

Track your net worth by setting up the following types of categories in your financial tool:

ASSETS:

- Your Home

- Investment real estate / properties

- Stocks

- Mutual Funds

- Bonds and other investment products

- Cash in the bank

- Vehicle(s)

- Boat

- Jewellery

- Gold

- Fine Art

LIABILITIES:

- Home (mortgage)

- Line of Credit (typically used to finance significant things like home renovations)

- Personal Debt (money you own to family, friends or the bank)

- Car Loan(s)

- Credit Card

Your Net Worth = Assets minus your Liabilities.

You only need to track your net worth on an annual basis once you’ve set up a good tracking system. For me, this is just a simple Financial Spreadsheet.

What is net worth by age

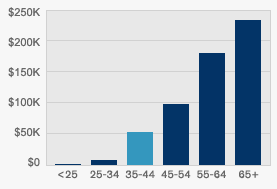

Median Net Worth by Age Range in United States as of 2017, USD (source Financial Samurai.com)

Median Net Worth by Age Range in United States as of 2017, USD (source Financial Samurai.com)This chart illustrates perfectly how your Net Worth should grow as you age and what is net worth.

While you may not live in the USA, this is indicative of Net Worth if you live in the Western world.

As you can see, Net Worth starts off very small when you are young (< 25) and can grow exponentially by the time you reach retirement age through a combination of spending wisely (avoid materialism spending at all costs) and investing wisely.

In fact, the median Net Worth is low if you are wise with your spending and investing and it is very possible to build a Net worth in the range of $ 1M to $ 5M (or more if you own a successful business), using principles taught at the 100 Goals Club.

Depending upon the country you live in and your individual circumstances however, the above Net Worth chart may either seem impossible to attain or it may seem inadequate for you. There is no right or wrong answer, other than to say the higher your Net Worth, the more opportunities you'll have to achieve your 100 Life Goals.

A great site to learn about finances and Net Worth is Financial Samurai, a US based site that I visit frequently due to the integrity of the site developer and the level of good financial advice delivered on this site.

Top one percent in the world

According to Investopedia in 2020,

- to be in the top 1% of income earners in the world, you need an income of $ 32,400

- to be in the top 1% in terms of wealth and net worth, you'd have to possess a net worth of $ 770,000

If you live in a developed country, it notes that these numbers are low due to the extreme poverty that exists in much of the world.

It also notes that 1% of the world's population hold almost 50% of the global wealth, according to Credit Suisse's 2018 Global Wealth Report.

My original Net Worth goal

One of my original 100 goals, at the age of 30, was to achieve a net worth of two million dollars—a number I determined would be sufficient to retire in Canada. If you live in another country, this number could be entirely different for you.

We've been fortunate (lucky too) to accomplish this goal ahead of retirement. One of the main reasons is that we own real estate in one of the best real estate markets in North America.

This increase in net worth, from the time I wrote out the goal, has been a significant contributor in our ability to accomplish so many of these 100 goals.

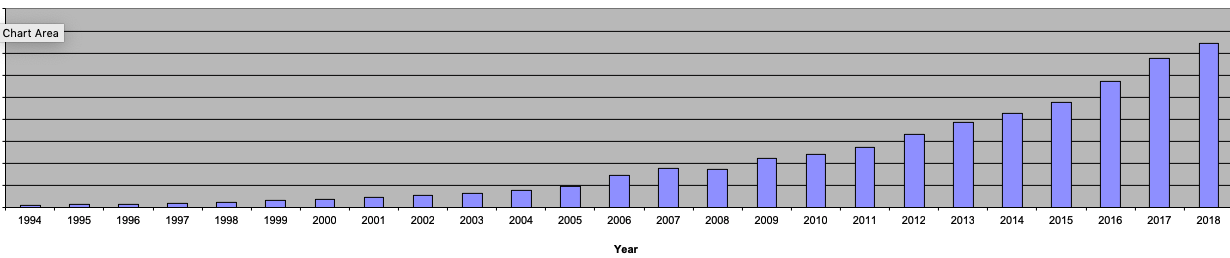

Through following the principles outlined in this Financial Goals section—specifically the next 2 goals of owning investment real estate and investing 10% of our income— we have exceeded this goal and have been fortunate to have our net worth grow at a rate averaging > 10% per annum, for more than 20 years.

This is an example of how Net Worth can grow over a long period of time, with Net worth in dollars tracked by year.

This is an example of how Net Worth can grow over a long period of time, with Net worth in dollars tracked by year.The very act of tracking your net worth will inspire you to make good financial decisions that will allow it to grow. If you understand the concept of what is net worth, you are well on your way to developing it.

Suggested Goal(s): Develop a system for tracking your net worth.

Your Outrageous Goal: Develop a net worth of more than $X million.

Return to financial goals.

Last updated: January 18, 2020