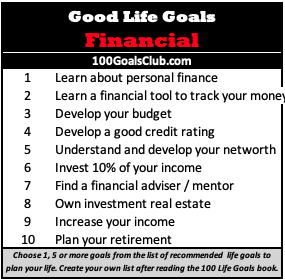

Financial Life Goals that will create your financial future!

Developing financial life goals and understanding how money works is essential to living your life of abundance. While money is not everything, and being obsessed about money is bad, most people agree that having enough financial wealth to live a comfortable lifestyle is important. Depending upon the type of goals you set for yourself, considerable financial net worth may be required. To travel the world, you'll need the financial resources to do so.

The purpose of this goal category is to help you understand the need to learn about money, and to track it, and do things to increase your income and the growth of your asset base, so that you have the financial resources to live the life you dream of.

The following 10 financial life goals are designed to do just that.

41 - Learn personal finance 101 / good financial habits

42 - Learn a financial tool to manage your money

44 - Develop a good credit rating

45 - Track & develop your net worth

46 - Invest 10% of your income

47 - Find a financial adviser / mentor

48 - Own investment real estate

What are your Financial Life Goals?

The key to achieving good financial success is setting financial life goals. At age 30 and as part of my original 100 goals, I wrote out 4 specific financial goals to live my life by . . .

- Develop seven wealth guiding principles to follow

- Invest monthly 10% of Net income for long term growth

- Achieve an average annual rate of return of > 10% on our equity investments

- Retire at age 65 as a millionaire with net worth over $ 2 million dollars

There are literally hundreds of strategies for developing significant financial wealth. They all start with a foundation of understanding money.

Don't make the mistake of being careless with your money and your home finances. The benefit of being wise with your money and developing good financial habits now (see below) are critical to your future.

As many of these 100 Life Goals require money to achieve, setting up sound money strategies early in life are important. Once you understand the power of Compound Interest (reference Goal 41 - Learn personal finance 101), you will look at money entirely differently. Every dollar you save and invest now will multiply many times over if you have decades remaining in your life. Think about that the next time you visit your local Starbucks or McDonalds.

Here is a fundamental statement to getting wealthy over the long term:

"Average returns sustained for an above-average period of time lead to extraordinary returns."

For example, if you invest just $ 500/month for 30 years and average a 10% return in the stock market, you will have more than $ 1M with a total investments of $ 180,000 ($500/month x 12 months/year x 30 years), Increase your average rate of return to 12% and it will be worth more than $ 1.5M!

Good financial life goals to change your destiny with money!

Good financial life goals to change your destiny with money!The rule of 72!

If you don't yet understand the Rule of 72, learn it now. So many people have not heard of this very important rule and once you learn it, it will change the way you think about money. It will certainly factor prominently in the way you think about your long-term financial goals.

The difference between earning varying rates of return (i.e. 3%, 5%, 7%, 10%, 15% etc.) is easily determined by dividing the rate of return into the number 72. The answer will reveal to you how long it will take for your money to double, in years.

- If you earn a 5% return, your money will double in 14 years (72 divided by 5 = 14).

- If you earn a 10% rate of return, your money will double every 7.2 years (72 divided by 10 = 7.2).

- If you earn a 20% rate of return, your money will double every 3.6 years (72 divided by 20 = 3.6).

Through the principles taught at the 100 Goals Club, it is possible achieve a rate of return between 10 and 20% per annum, as my wife Kathy and I have been able to achieve.

Throughout your life, this simple rule will give you an important insight into how much money you will develop throughout your life. It changed my view on how to look at different investment returns and helps me decide how much risk I am willing to take.

Good financial habits

It is important that you learn as much as you can about personal finance, and develop, early on, good financial habits that will last throughout your life time. Examples of good financial habits include . . .

- Avoid consumer debt and not buying things that you can’t afford to buy with cash in the bank.

- If you use credit cards, pay off the full balance each month.

- Don’t try to "keep up with the Joneses". They are likely deep in debt.

- Live more frugally in the first part of your life when you are setting up your asset base for long-term growth (see Goals # 42 Learn a Financial tool to manage your money)

- In a 2-person household, live on one income and save or invest the other.

- Minimize or eliminate spending money on things you purchase at a premium for convenience which you can easily purchase at the grocery store (i.e. coffee, muffins, water etc.)

- Use good debt to buy assets that appreciate (i.e. real estate, stocks, artwork)

There are thousands of good books, blogs and websites about developing your financial habits to support your goals. The important thing is that you take a serious view of your financial future and develop solid life goals for you and your family.

Keep reading this site to developing a better understanding now.

My best financial advise to you

My wife and I have been good with money for most of our life. We both have good sets of parent role models who saved and invested their money, so it was natural for us to do the same. We've learned a few things along the way and here is what we would do differently if we were to start over again:

MANAGE OUR OWN MONEY - No one will value your money and be more interested in having it grow than you. It's only been through recent years through the wide availability of on-line brokerage accounts (like Questrade, Robin Hood, Wealth Simple), that you can manage your own accounts. With these on-line accounts, you can trade (buy and sell) stocks for a small fee, and even for free. Instead of investing in mutual funds or index funds which own a significant number of companies, focus instead on specific companies that represent great businesses (great products, great leader, long term industries, disruptive technologies etc.).

If managing your own money is new or scary for you, check out Life Goal # 47 - Find a financial adviser / mentor

INVEST IN WHAT YOU KNOW - Understanding what you invest in is important. I've noticed that once Kathy and I start using a company's products or services, that would have been the best time to invest. Think about when you purchased your first Apple product, started using Netflix, started shopping at Amazon or Costco as an example. Check out their stock price back at that time and check it out now and you'll see what I mean.

When I purchased my Tesla Model 3 about two year ago, that would have been the perfect time to buy Tesla stock. Unfortunately the financial adviser we work working with at the time talked me out of it. BIG MISTAKE for both of us! The price has increased by more than 20X. We've since left our financial adviser and have taken our investing into our own hands. And yes, we now own stock in TESLA and this is another example of owning stock in companies that you personally believe in because you use their products.

Before I retired, we owned significant stock in the publicly traded company that I was employed with (L3 Communications which became L3 Harris). It is a great company that was demonstrated through it's stock performance over the past 15+ years with returns well in excess of 15% per annum. If you work for a good company that is publicly traded, you should consider owning their stock too.

DON'T DIVERSIFY TOO MUCH - Contrary to popular advice to diversify your investments, my belief is that you will significantly limit your growth potential by over diversification. It is better to understand a handful of strategic investments or stocks (i.e. up to 10 maximum), than to be so diversified that your returns are watered down. You could also own a healthy amount of Exchange Traded Funds (see next point below). My suggestion is that somewhere around 50% of your investment portfolio is in ETF's. We are currently much less than 50% however as we have become Tesla "Bulls" and recently have gone "all-in" on Tesla. This would be viewed as a risky move by many but we believe so much in their products, leader (Elon Musk) and future (sustainable energy), that although the stock is volatile (can swing up or down 30% in a week), the value of Tesla stock will most certainly by higher in 5 or 10 years, with an upside of 10X or more.

BUY EXCHANGE TRADED FUNDS (ETF) - It is now recognized that most mutual funds and money managers do not generate returns that beat that of of common exchange funds that track the holding of stocks on the various stock exchanges (i.e. S&P 500, NASDAQ, DOW, TSX etc.). The management fees in owning an ETF are drastically lower than that paid to a professionally managed fund. This alone will add tens and possibly hundreds of thousands of dollars to your return at the end of 30 or 40 years. If this all sounds foreign to you and you don't understand investing in general, it's time you educate yourself.

INVEST IN BOTH REAL ESTATE AND THE STOCK MARKET - For much of our life, we focused heavily on real estate investing and that was a great decision for us. While we've also invested our money throughout this time, I was not actively managing our investments like I am now. If I was to go back in time, I would have paid more attention to our stock market investment decisions.

INVEST MORE AND SPEND LESS - As you get older, you realize that a lot of the stuff that you accumulate throughout your life was not worth it and would have been better invested. Think of every $ 1 you spend money on as a lost opportunity for $ 50 to $ 100 down the road. With the power of compound interest and the rule of 72, if you can manage to grow your money at 10% to 20% per annum, that is how much your $ 1 will grow to in 30 to 40 years!

A summary of my investment philosophy and that of the 100 Goals Club

- Invest minimum 10% of your gross income for your retirement (but target 20% if you want to be wealthy)

- Target an annual return of 10% per year minimum on your investment (but target 20%). A financial planner will tell you that 6% is a safe number to plan your retirement on. My experience and my expectations are much higher!

- Don't become a day trader in the stock market. Invest in solid growth oriented companies and Exchange Traded Funds (ETF) in industries that are expected to grow.

- Understand what you are investing in

- Have a long term horizon when you invest (years or decades, not days or months)

- Know what Compound Interest is and learn the RULE OF 72. See the difference a few percent will make 30 years from now by achieving a 10-20% annualized return versus 7%.

- Spend less money on buying lots of things and instead buy fewer things of higher quality

- Take care of your own money, no-one else will

- Strive to be financially free, where you don't need to depend on job income to have a good lifestyle

Last updated: February 10, 2022